As a business owner in New York State, you’re responsible for more than just workers’ compensation. You also have obligations regarding disability benefits for your employees. Let’s clarify what you need to know to ensure your business is compliant.

NYS Disability Benefits: A Quick Overview

New York State law requires most employers to provide disability benefits coverage to their employees. These benefits provide temporary cash payments to eligible employees who are unable to work due to a non-work-related injury or illness.

Why Compliance Matters

Providing disability benefits coverage is not optional; it’s a legal requirement. Failing to comply can result in penalties and legal issues for your business.

Key Compliance Points for Businesses:

- Mandatory Coverage: Ensure that you have a disability benefits insurance policy in place that meets the requirements of New York State law.

- Employee Awareness: Make sure your employees know that disability benefits coverage is available to them.

Where to Direct Employees

Be prepared to direct employees to the appropriate resources (your insurance carrier or the Workers’ Compensation Board) if they have questions about this coverage.

Ensuring Compliance

- Work with Your Insurance Provider: Your insurance agent or provider can help you ensure that you have the correct disability benefits coverage in place.

- Stay Informed: Keep up-to-date with any changes in New York State disability benefits law.

By understanding your obligations and taking the necessary steps, you can ensure that your business is compliant with New York State disability benefits law and that your employees are protected.

Frequently Asked Questions (FAQs): NYS Disability Benefits Compliance for Business Owners

Q: What are New York State Disability Benefits?

A: New York State Disability Benefits are legally required coverage that provides temporary cash benefits to eligible employees who are unable to work due to a non-work-related injury or illness.

Q: Why are Disability Benefits important for business owners?

A: New York State law mandates that most employers provide disability benefits coverage to their eligible employees. This is a legal obligation for business owners.

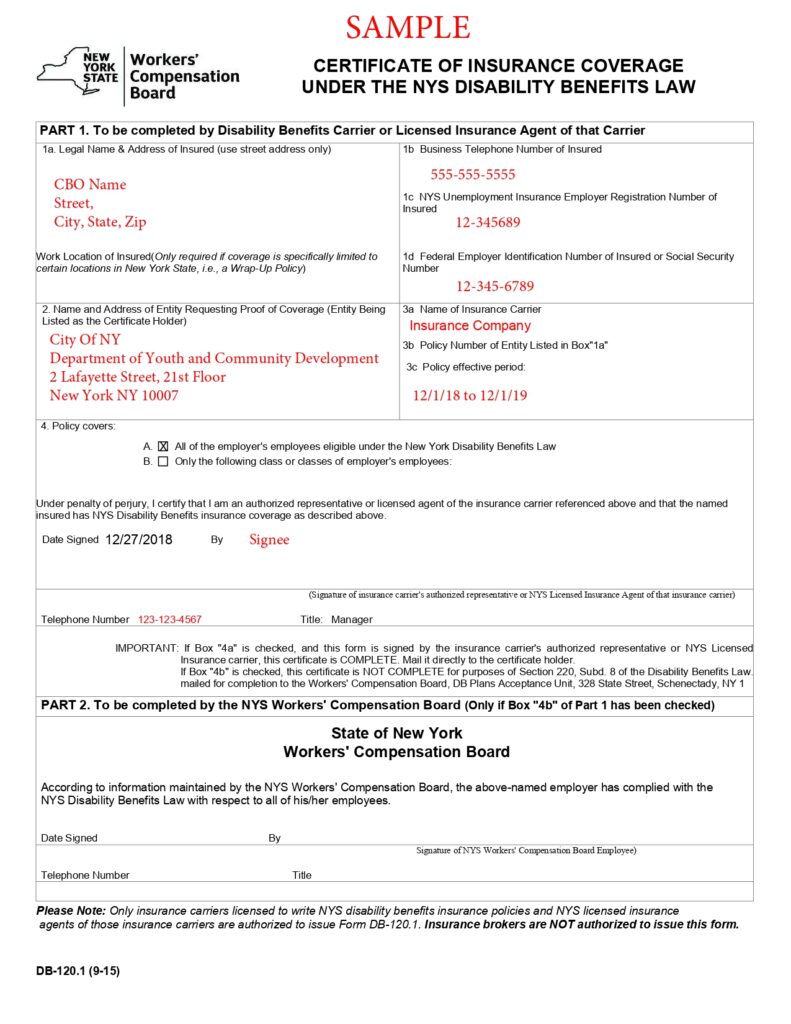

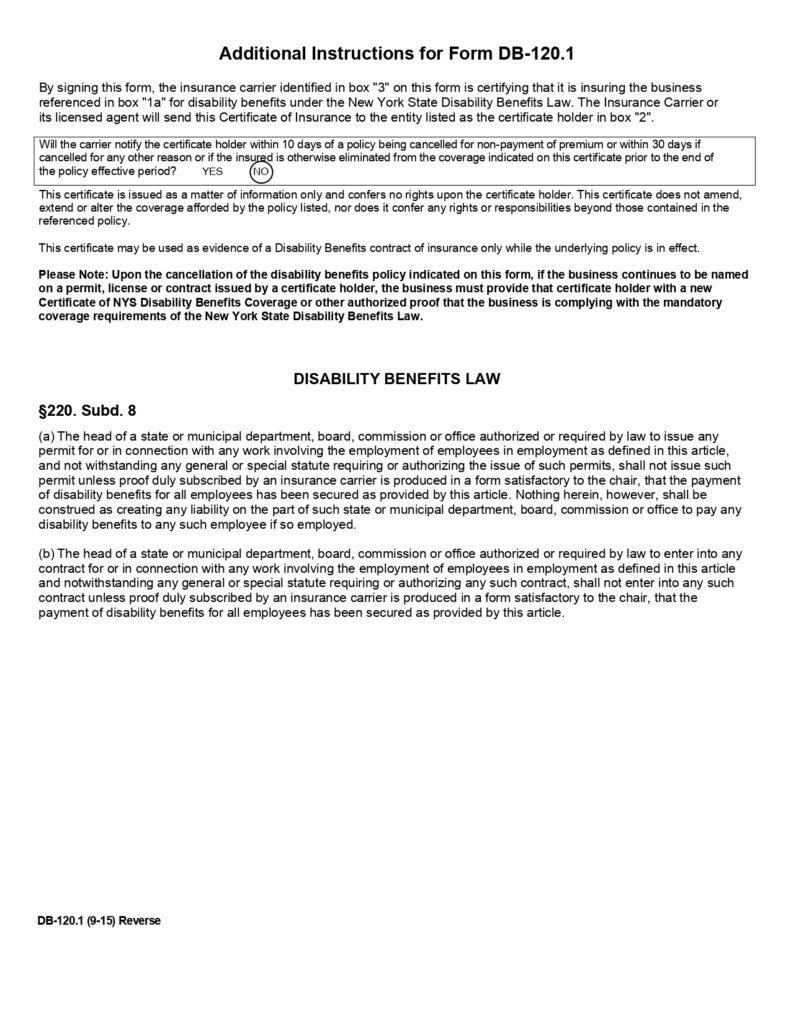

Q: What is the DB-120 Form’s relevance to business owners?

A: While the DB-120 form is used by employees to apply for benefits, it highlights the fact that employers must have compliant disability benefits coverage in place.

Q: What are the key compliance points for business owners regarding NYS Disability Benefits?

A:

- Employers must have a disability benefits insurance policy that meets New York State law requirements.

- Employers should ensure employees are aware that disability benefits coverage is in place.

Q: Where can business owners get information about NYS Disability Benefits compliance?

A: Business owners should contact their insurance carrier or the New York State Workers’ Compensation Board for detailed information on compliance requirements.