When you apply for commercial auto insurance, one of the key pieces of information your insurer needs is the garaging address of your vehicles. This might seem like a minor detail, but it plays a crucial role in determining your premium. Let’s delve into why this is important and what you need to know.

Why Does Garaging Address Matter?

Insurance companies use various factors to calculate your premium, including the ZIP code where your vehicles are primarily parked or garaged overnight. This location directly impacts the risk assessment because:

- Varying Risk Levels: Different areas have different rates of theft, vandalism, and accidents.

- Accurate Rating: Using the correct garaging address ensures your premium accurately reflects the risk associated with where your vehicles are parked.

What Is Proof of Garaging?

Sometimes, your insurer might request proof of your garaging address. This is especially true if:

- Your garaging address differs from your business’s official address.

- There are discrepancies in the information provided.

Acceptable Proof of Garaging Documents

To verify your garaging address, you may be asked to provide documents such as:

- Homeowner’s or business owner’s insurance declarations page.

- Utility bills (gas, electric, water, etc.).

- Mortgage coupons.

- Property tax documents.

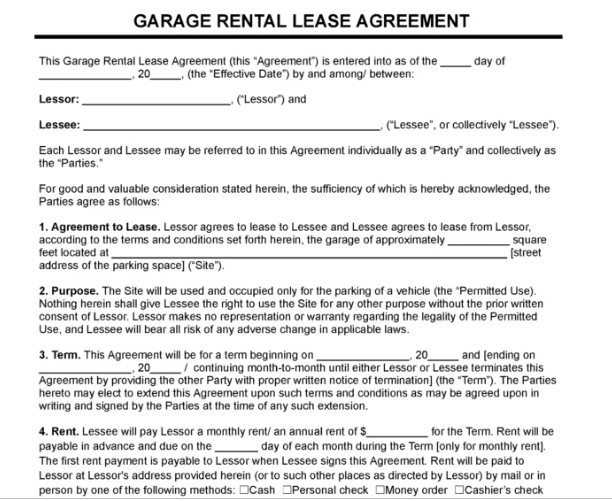

- A signed rental or lease agreement.

What You Can Do

- Provide Accurate Information: Always provide the correct garaging address when applying for insurance.

- Keep Documentation Ready: Have the necessary documents on hand in case your insurer requests proof.

- Communicate with Your Insurer: If you have any questions or concerns, don’t hesitate to contact your insurance agent.

Why Is This Important?

Providing accurate garaging information helps:

- Prevent premium adjustments or policy cancellations.

- Ensure you have the right coverage for your business.

Conclusion

Understanding the importance of proof of garaging can help you avoid potential issues with your commercial auto insurance. By providing accurate information and keeping the necessary documentation, you can ensure your policy accurately reflects your business needs.